Forex trading, also referred to as international exchange trading or currency trading, could be the world wide marketplace for getting and offering currencies. It runs twenty four hours each day, five times weekly, allowing traders to participate on the market from anywhere in the world. The primary purpose of forex trading is always to benefit from changes in currency trade costs by speculating on whether a currency set can rise or fall in value. Individuals in the forex industry include banks, financial institutions, corporations, governments, and personal traders.

Among the important options that come with forex trading is its high liquidity, and thus large amounts of currency are available and distributed without significantly affecting change rates. That liquidity assures that traders can enter and quit roles rapidly, permitting them to take advantage of even little value movements. Additionally, the forex industry is very available, with reduced barriers to access, allowing individuals to begin trading with fairly little levels of capital.

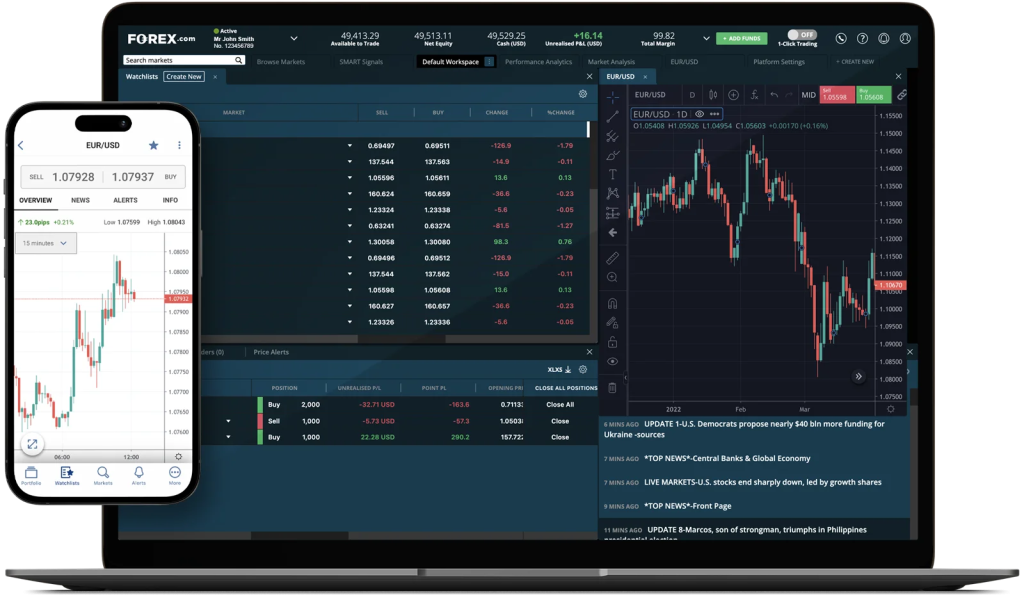

Forex trading offers a wide selection of currency sets to industry, including major pairs such as for instance EUR/USD, GBP/USD, and USD/JPY, as well as small and spectacular pairs. Each currency set presents the change rate between two currencies, with the first currency in the set being the beds base currency and the next currency being the estimate currency. Traders may benefit from equally rising and falling areas by using long (buy) or small (sell) roles on currency pairs.

Successful forex trading needs a solid knowledge of simple and specialized analysis. Fundamental examination involves considering economic indicators, such as for example interest charges, inflation costs, and GDP development, to assess the underlying strength of a country’s economy and its currency. Specialized evaluation, on another give, involves studying cost maps and patterns to recognize tendencies and possible trading opportunities.

Risk administration can be important in forex trading to guard against potential losses. Traders usually use stop-loss requests to restrict their downside chance and utilize correct position sizing to ensure that no single deal may significantly impact their overall trading capital. Additionally, maintaining a disciplined trading strategy and controlling emotions such as greed and anxiety are vital for long-term achievement in forex trading.

With the development of engineering, forex trading has are more accessible than actually before. On line trading platforms and portable programs give traders with real-time access to the forex industry, letting them perform trades, analyze market data, and control their portfolios from any device. Furthermore, the availability of academic forex robot resources, including lessons, webinars, and trial reports, empowers traders to develop their skills and boost their trading efficiency around time.

While forex trading presents significant profit possible, in addition, it holds natural risks, including the potential for considerable losses. Thus, it’s needed for traders to perform complete study, produce a noise trading strategy, and constantly check market situations to produce knowledgeable trading decisions. By sticking with disciplined chance administration practices and remaining informed about global financial developments, traders may enhance their chances of success in the vibrant and ever-evolving forex market.